But... how does peer-to-peer (P2P) lending work?

It all starts with a person who is looking for a loan (borrower), while TWINO loan originators are always here to help.

Each borrower that applies for a loan to our loan originators is going through an in-depth credit risk scoring procedure to receive the loan. Only the loans that have gone through this credit scoring procedure are being sent to TWINO investment platform.

TWINO earns revenue at the lending side by charging interest and commissions for the lent capital. Part of this income is paid to you in a form of interest income for your invested capital, while the other part stays in our business to cover costs and earn a profit.

Consumer loans

Invoice financing

Business loans

Real estate

Consumer loans

Invoice financing

Business loans

Real estate

Assessing the credit risk of individual borrowers & issuing loans

Borrowers apply for loans on our loan originators' websites. In a short period of time (minutes not hours) our technology is evaluating the creditworthiness of the specific applicant by taking into account the information provided in the application form, officially available information on existing liabilities, and hundreds of individual data points. If the borrower qualifies for a loan, then we grant the funding.

Loans are sent to TWINO investment platform

The loans are being sent to TWINO investment platform after the borrower has been identified, scored and the decision to issue the loan has been made. Meaning that you as an investor do not need to evaluate each individual loan, as we have already done this for you and with your peace of mind at the forefront.

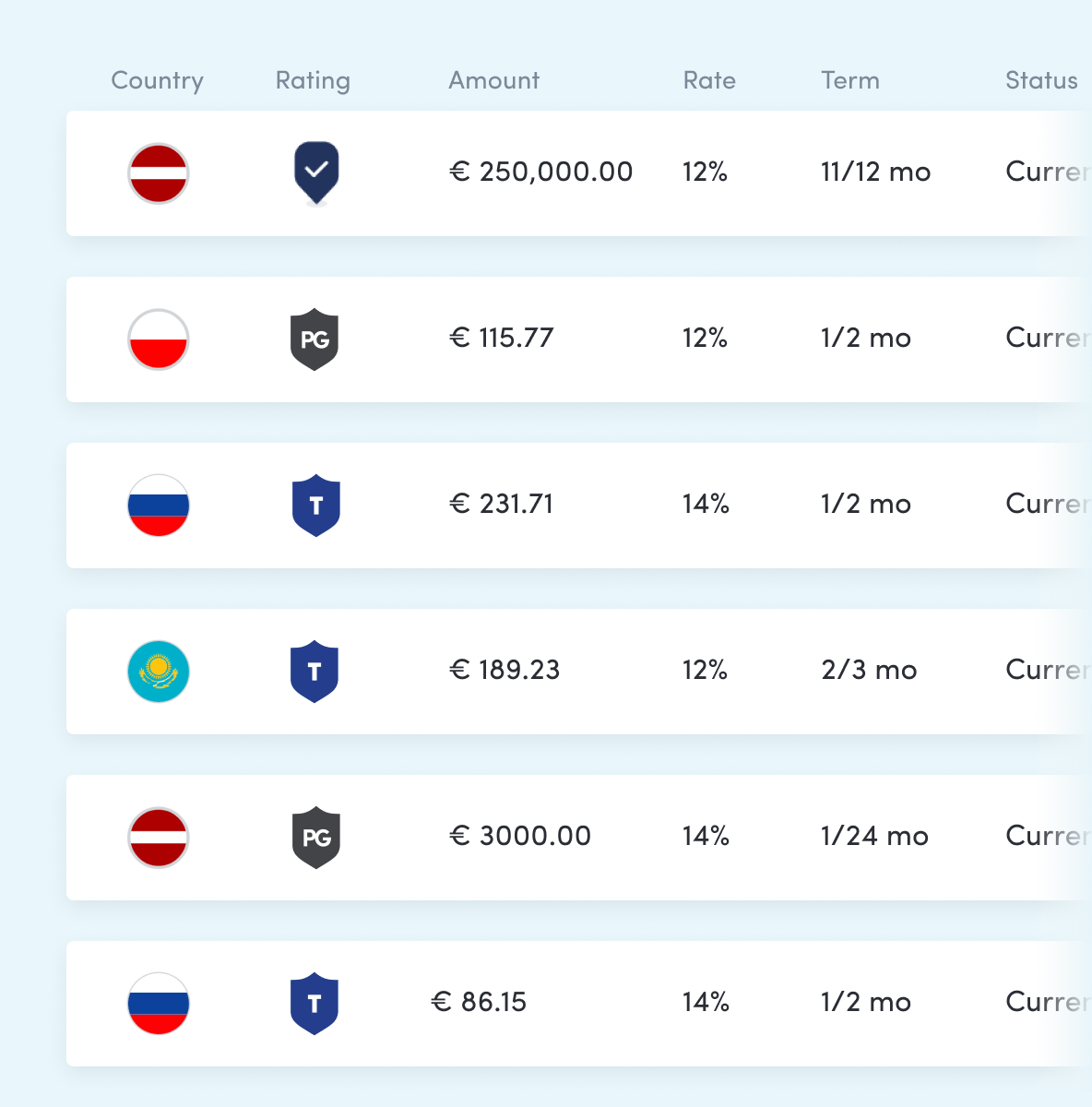

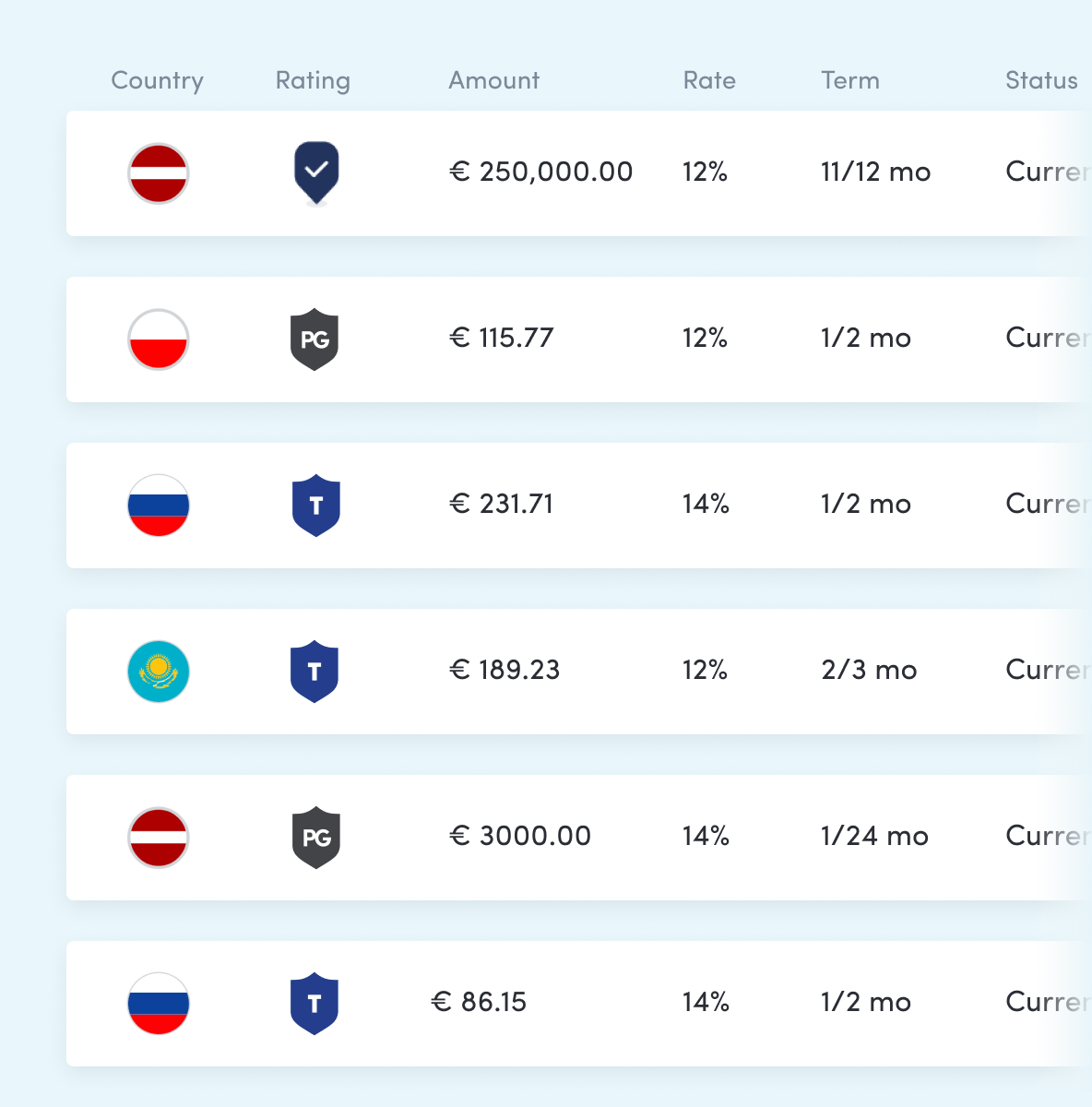

Loans are available for investments

Now, as the loans have successfully arrived on the TWINO investment platform, they can be funded by you as an investor. Instead of directly owning each loan, your investment is made into Asset-Backed Securities (ABS), which are financial instruments backed by claim rights against the loan originator.

This structure means that your repayment is not tied to whether individual borrowers repay their loans. Instead, the loan originator — a licensed legal entity — is obliged to ensure cash flows. That makes the income stream safer and more predictable for you as an investor.

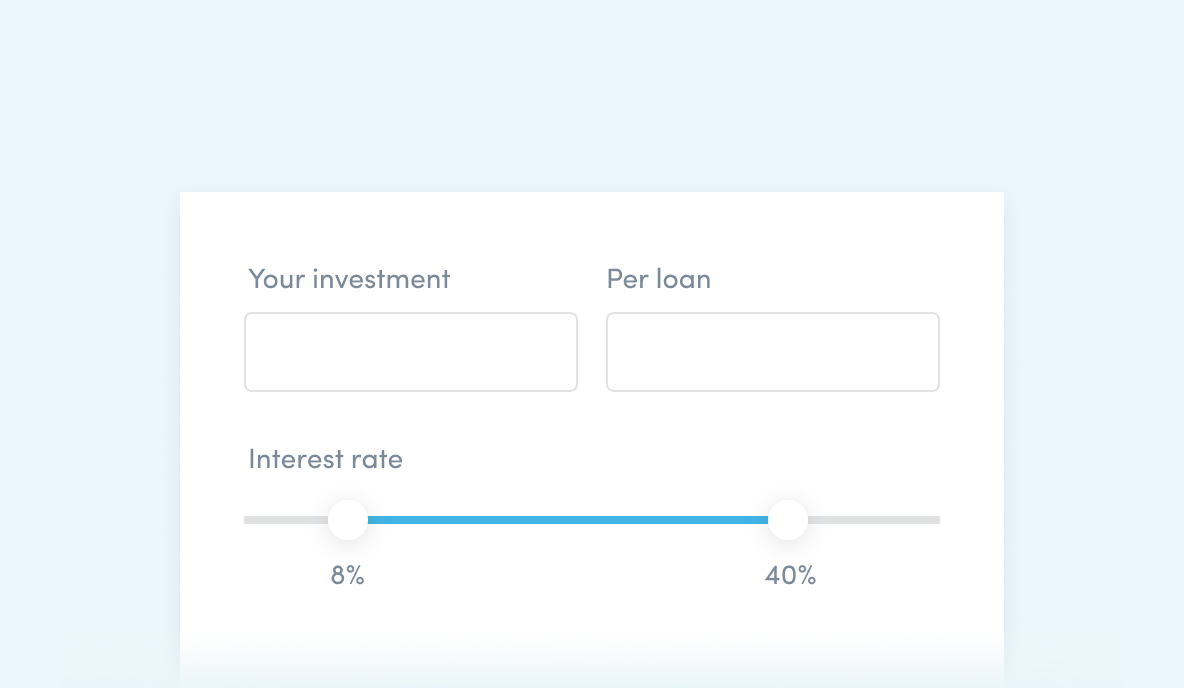

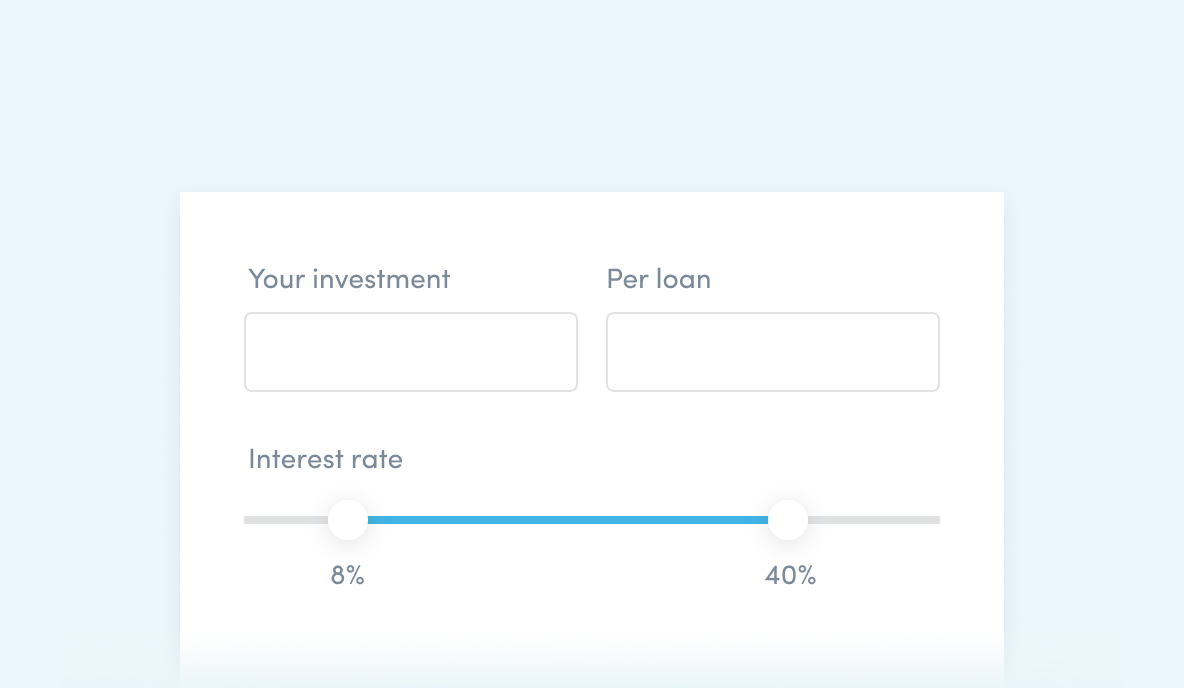

Set up your first Auto-invest portfolio

We believe that passive investments are the best and with that in mind, TWINO's Auto-invest tool was created. Its main goal is to invest your funds in multiple individual loans based on criteria that you set up on your investor profile. This makes the diversification process completely hassle-free and you will still be able to see each individual loan where you have invested.

Earn interest income

You will receive the interest income based on which loans you have funded. On average, TWINO investors have earned more than 10% p.a., which is hard to beat with any other kind of investment and even harder to beat with another kind of passive income-generating investment.

Ready to start?

Set up your account in minutes and start investing in loans around the world